So You Want To Start A Real Company. Here Is The Logistical Stuff No One Talks About.

Most people think starting a business means picking a cute name, making a Canva logo, and launching an Instagram page. That is not a company. That is a hobby with a marketing plan.

A real company has structure. A real company has protection. A real company has the boring but essential paperwork that feels unnecessary until the day it saves you.

If you are serious about building something sustainable, you need more than creativity and momentum. You need logistics. The unsexy steps. The grown up steps. The steps that turn your idea into an actual legal business.

Here is what creators and entrepreneurs never learn until they are already cleaning up a mess.

Step 1: Choose and Clear Your Business Name

Everyone wants to start with branding. Fonts. Colors. Aesthetic. But the first real move is choosing a name you can legally use and keep.

Before you fall in love with the name, do three checks.

- Search your state business registry to make sure the name is not already taken.

- Search domain availability. Do you have a clean URL you can use.

- Search the federal trademark database to confirm no one in your category owns it.

Do a quick Google and social media check as well. If someone in your industry already uses a similar name, move on. You need clarity, not confusion.

Why it matters

Your name becomes the foundation for everything that follows. LLC. EIN. Bank accounts. Contracts. Licenses. If you skip this step or get it wrong, you will end up redoing everything and confusing your future customers. And honestly, it will totally suck. It can feel so deflating that many people quit right here. Start with a name you can actually keep so you protect your momentum and avoid that early burnout moment.

Step 2: Register Your Business Entity

Once your name is confirmed, file your LLC. Every state has an online process that takes only a few minutes. Some people use services like LegalZoom or ZenBusiness, but most solopreneurs can do this themselves. I did. It is super easy. And if you get confused, ask your favorite AI. They will walk you through it step by step.

You will receive your Articles of Organization or your state’s equivalent. Save them. These are your official legal documents.

Why it matters

Without an LLC, there is no separation between you and your business. If something goes wrong, your personal money and assets are exposed. With an LLC, you create a legal barrier that protects you.

Step 3: Get Your EIN

Your EIN is your business’s identification number. It is completely free and issued through the IRS website.

Use your exact legal business name and address. When the confirmation letter downloads, save it to a safe place.

Why it matters

Your EIN unlocks everything else. Payment processors. Bank accounts. Accounting systems. Tax filings. Never run your business under your personal SSN. That is one of the biggest mistakes new entrepreneurs make.

Step 4: Apply for Your Business Licenses

Requirements vary by state and city. Some cities require general business licenses. Some industries require special permits. Your Department of Revenue or City Clerk website usually has a simple guide.

Spend an hour researching what you need. It saves you from fines and compliance issues later.

Why it matters

Licensing your business does more than keep you compliant. It signals that you are not running a side project. You are building something real.

Step 5: Open a Business Bank Account

This is where your business becomes financially legitimate.

Open a checking account in your legal business name using your LLC documents and EIN. Choose a bank with low fees and easy online access. This account becomes your operating hub.

Why it matters

Mixing personal and business money destroys your liability protection. It also makes tax season a nightmare. Clean financial separation is the foundation of real leadership.

Step 6: Set Up Your Accounting System

You need a way to track your revenue and expenses. This can be as simple as a spreadsheet or as advanced as QuickBooks or Wave.

Create categories for income and expenses. Set a weekly or monthly money date to review everything. Keep your receipts in digital folders.

Why it matters

You cannot make smart business decisions if you do not know where your money is going. Accounting is clarity. Clarity is power.

Step 7: Secure Your Digital Real Estate

Once your name is official, grab it everywhere you can.

Buy the domain. Claim your social handles. Lock in variations you may want later for sub brands or future products. Keep everything as consistent as possible.

Why it matters

Brand confusion kills credibility. Owning your digital identity early keeps your brand clean and protects your future growth.

Step 8: Get Business Insurance

If you offer services, coaching, consulting, or digital products, start with general liability and professional liability coverage. If you sell physical products, you will need product liability insurance as well.

Why it matters

Insurance feels unnecessary until you need it. Then it becomes the most important monthly expense you have.

Step 9: Create Your Contracts and Legal Documents

Contracts are not about mistrust. They are about clarity and respect.

If you have a partner, you need an operating agreement.

If you have clients, you need service agreements with clear terms.

If you hire contractors, you need contractor agreements and NDAs.

Templates are fine to start. Lawyers are great as you grow.

Why it matters

Structure prevents conflict. Expectations prevent resentment. Contracts protect everyone involved.

Step 10: Set Up Your Payment Systems

Choose platforms that fit your business model.

Stripe.

PayPal.

Square.

Kajabi.

Thrivecart.

Shopify.

Connect your business bank account and test everything before you accept your first payment.

Why it matters

If paying you is difficult, people will not pay you. A clean checkout experience creates trust and makes your business easier to scale.

Step 11: Understand Your Tax Responsibilities

Most small businesses need to pay quarterly estimated taxes. Some need to collect sales tax depending on what they sell and where customers are located.

Book at least one session with a CPA who understands small businesses and online entrepreneurs. Their guidance will save you money and stress.

Why it matters

The IRS does not care that you are new. Getting ahead of taxes keeps your business safe and your mind calm.

Here is the part no one tells you

Starting a real company is not hard. It is only unfamiliar. Most of these steps take minutes, not months. The hard part is believing you are capable of building something real.

When you set the foundation correctly, everything else becomes easier.

Your operations.

Your client experience.

Your growth.

Your confidence.

This is what alignment looks like.

Want the full process with step by step instructions, links, cost ranges, and expert recommendations

If you want more than the overview, I created a complete resource to walk you through every step in detail.

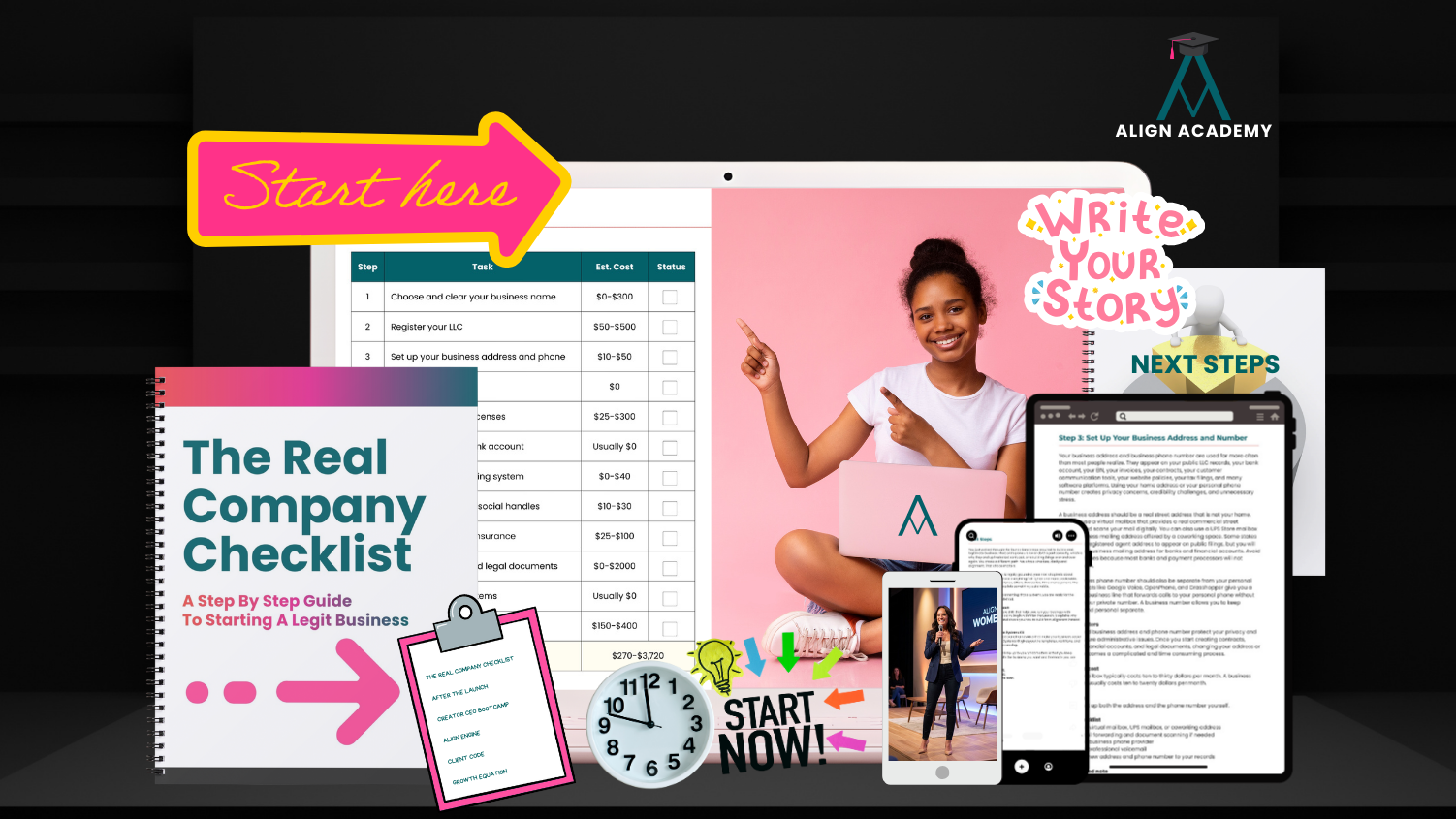

The Real Company Checklist

Your step by step guide to legally and operationally starting a real business.

Inside you will find

Exact links to where you need to go

Estimated costs for every step

Recommendations on what to DIY and what to outsource

The most common mistakes and how to avoid them

Notes from my own experience building companies the aligned way

If you are ready to start your company the smart way, get the full guide at

www.AlignMethod.org

Start aligned. Build strong. Grow with confidence

You already built the dream. Now make it sustainable with Align Method.

Follow Align Method

Want to build a business that sells with conviction, not control. That is what I teach inside Align Method, where strategy meets psychology and systems meet soul.

Go to www.AlignMethod.org for real talk about growth, influence, and aligned entrepreneurship.

See Align Method’s Legal and Policy Hub for complete legal and policy information.

DISCLAIMER: The content shared on Unfiltered Alignment is for educational and informational purposes only. It reflects my experience, my opinions, and my perspective on building aligned, sustainable businesses. It is not legal, tax, financial, or professional advice. Every business has unique needs, and requirements vary by state, city, industry, and individual circumstances. Please consult with a qualified attorney, accountant, or licensed professional before making decisions that affect your business, finances, or compliance. Align Method and Shelley are not responsible for any actions taken based on this content.

Leave a comment